- FHB COMMERCIAL MORTGAGE CALCULATOR INSTALL

- FHB COMMERCIAL MORTGAGE CALCULATOR CODE

- FHB COMMERCIAL MORTGAGE CALCULATOR PASSWORD

- FHB COMMERCIAL MORTGAGE CALCULATOR PC

FHB COMMERCIAL MORTGAGE CALCULATOR CODE

After you have verified your mobile phone number, send a SMS to the First Citizens Mobile Text short code 34778 (FIRST) using one of the commands.Each of these quick codes will request an SMS with the information shown below :

FHB COMMERCIAL MORTGAGE CALCULATOR PASSWORD

By using letters, numbers and symbols this reduces the likelihood that your password can be guessed.

FHB COMMERCIAL MORTGAGE CALCULATOR INSTALL

Install the latest Ant-Virus software to safeguard against viruses, in addition to regular virus sweeps of your system.Ensure that you install the latest security patches and updates to correct weaknesses in your system – it only takes one point of entry for hacking to occur.

FHB COMMERCIAL MORTGAGE CALCULATOR PC

For real properties located in Saipan only.Below are Five important tips to ensure that your Online Banking experience is optimised by protecting your PC from fraudulent attempts. Not available through mortgage originator companies.

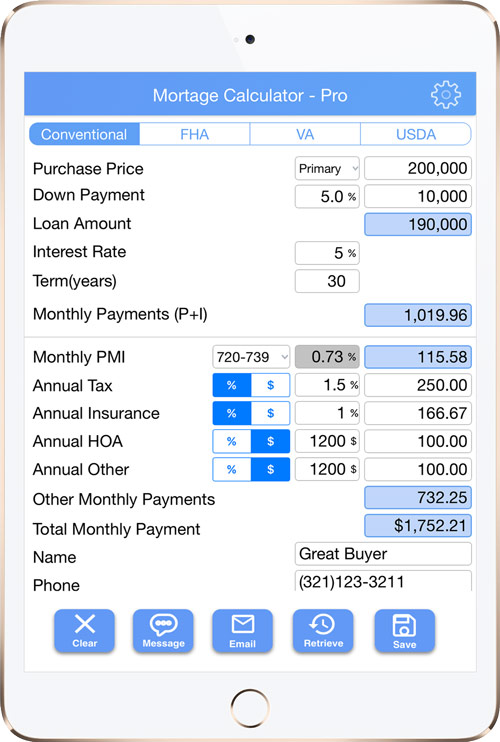

Payments do not include amounts for taxes and insurance premiums, if applicable, and actual payment obligation may be greater. 30-day and 60-day lock pricing are also available to fit your lending needs.

The rates and fees quoted are subject to change at any time and are based on a 45-day lock period. For real properties located in the State of Hawaii and Guam only.Ģ Annual Percentage Rate (APR) and monthly principal and interest payments are calculated based on owner-occupancy, 30% down payment, the respective rate, related fees, and associated expenses. Adjustments for the 3, 5, 7, and 10 year Adjustable Rate Mortgages (ARMs) is based on the 30 Day Average of the Secured Overnight Financing Rate as published by the Federal Reserve Bank of New York, plus a margin of 2.75% for owner-occupant, 3.25% for investors.Ģ Annual Percentage Rate (APR) and monthly principal and interest payments are calculated based on owner-occupancy, 20% down payment, the respective rate, related fees, and associated expenses. Adjustable Rate Mortgages (ARMs) adjust after the initial fixed rate period and your interest rate can increase or decrease every 6 months according to the current index.

0 kommentar(er)

0 kommentar(er)